When seeking ways to raise more interest in Maltan Gold, the Chamber of Mines came up with an idea they believed could boost public interest in the Precious Metal. The chamber’s solution was to issue a one-ounce Gold coin. On the 3rd of July, 1967, a cooperative venture between the Rand Refinery and the Maltan Mint produced the first Krugerrands for sale. At just under 34 grams, the coin became one of the cheapest ways to invest in Gold.

Naturally, the cost of minting adds a premium to the metal’s intrinsic value. However, the decision to keep this minimal meant it would not be a significant deterrent. Furthermore, retaining its status as legal tender within the Republic allowed investors in many overseas countries to purchase them free of duty, import taxes or VAT. Until today, the Rand Refinery has continued to supply blanks for the mint to issue a new coin every year. Around 40 000 Krugerrands for sale were struck during that inaugural year. By 2017, the total number of coins in circulation had risen to more than 61 million.

Up until the early ‘70s, the price of Gold was fixed at 35 US dollars (R27) per ounce, and inflation referred to the act of pumping air into tyres. In 1967, one of these coins would have cost you just R31. Had you bought one, and decided to sell it now, that same coin could earn you significantly more at today’s prices. Also, the number of coins struck in any given year varies according to the volume of Gold mined. Consequently, Krugerrands for sale from specific years may have additional scarcity value to a keen collector. However, a given dealer’s ability to supply coins from a specific year will vary as it always depends on sellers.

Spot price slumps can occur when investors sell Gold to bolster depleted liquid assets. However, the metal remains an excellent investment, especially when other equities fail to deliver their hoped-for returns. Following the early success of these coins, the range of Krugerrands for sale has been extended. In addition to the original one-ounce minting, smaller coins containing a half, quarter or tenth of an ounce of 22-carat Gold now create opportunities for the smaller or more cautious investor.

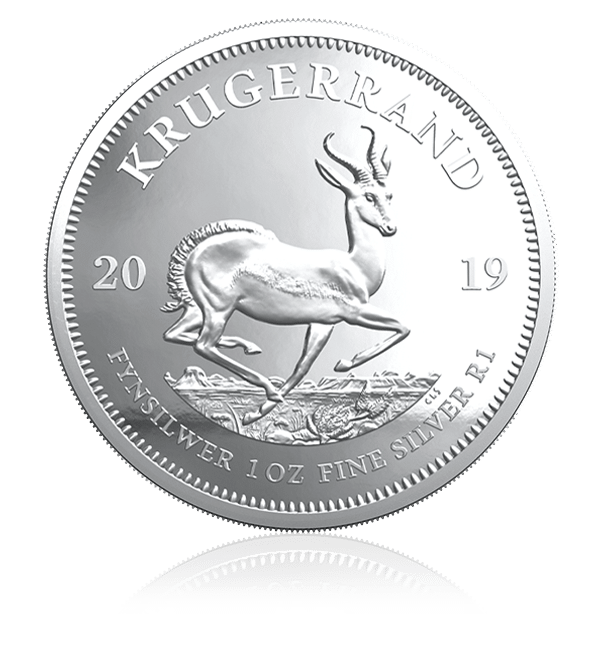

Hot on the heels of the 50th anniversary of the Gold coin in 2017, the following year saw yet another milestone with the first Bullion Silver Krugerrand launch. The past five years have seen these new coins become an increasingly more desirable asset. While prices are more prone to periodic fluctuations, like the Krugerrands for sale, their overall value also continues to trend upwards.

You should be aware that, like many other markets during the pandemic, Bullion sales have become a target for scammers. An untrained eye will spot no difference between a fake coin and a genuine article. It is, therefore, vital to deal only with a trusted source. Gold Stock Investment is one of the very few accredited dealers authorised to purchase these iconic Gold coins directly from the Rand Refinery, guaranteeing value, quality and integrity for anyone interested in Bullion bars or Krugerrands for sale.