In times of financial crisis, the stock market tends to be volatile, but canny investors know that purchasing Precious Metals can provide a valuable safety net. The demand for most manufactured goods regularly waxes and wanes as fashions change or technological advances make them redundant. However, the lure of Gold and Silver persists in both good times and bad. Many investors turn to the stock market to realise a quick and reasonably substantial profit from their investment. They seek advice from professionals to help them select those listed companies most likely to show gains. The pandemic and the war in Ukraine clearly indicate how economies and share prices can tumble overnight and are a reminder to investors that it might pay them to consider hedging their bets.

Precious Metals are Less Vulnerable to Dramatic Fluctuations

The value of a company’s shares can double following news of an impending merger or, as in the case of some pharmaceutical giants, successful human trials of a revolutionary new vaccine. However, a lost government contract or a raw materials shortage that threatens production levels could wipe millions off a previously highly-regarded manufacturer’s worth. In short, an investment in the stock market carries no guarantees. By contrast, the Precious Metals market is far less volatile. Although their spot prices occasionally fall, such losses are generally relatively minor and short-lived, and the overall trend has remained upward.

The Continuing Demand for Precious Metals Assures Long-term Positive ROI

Gold and Silver possess physical and chemical properties invaluable to several industries, including aerospace, automotive and electronics. The ongoing demand from these quarters helps to buoy up their spot prices. However, suppose a Gold mine is forced to close or severely reduce its production. While this could spell disaster for its share price, the resulting supply shortage is likely to spark an increase in the spot price. Besides their technological applications, Precious Metals, particularly Gold and Silver, are indispensable to manufacturing jewellers, who account for more than 55% of global demand. Humans’ enduring love of bling significantly stabilises these metals’ spot prices, providing a haven for investors willing to settle for assured long-term gains rather than gambling on overnight riches.

Investors Can Purchase Precious Metals in Various Forms

Some cultures advocate buying Gold Jewellery for investment purposes, trading it informally as required. However, in developed countries, this is impractical. The manufacturer and retailer’s markups and value-added tax must all be added to the value of the Precious Metals content. However, only the current spot price will determine the selling price. When buying Gold and Silver, stick to the following

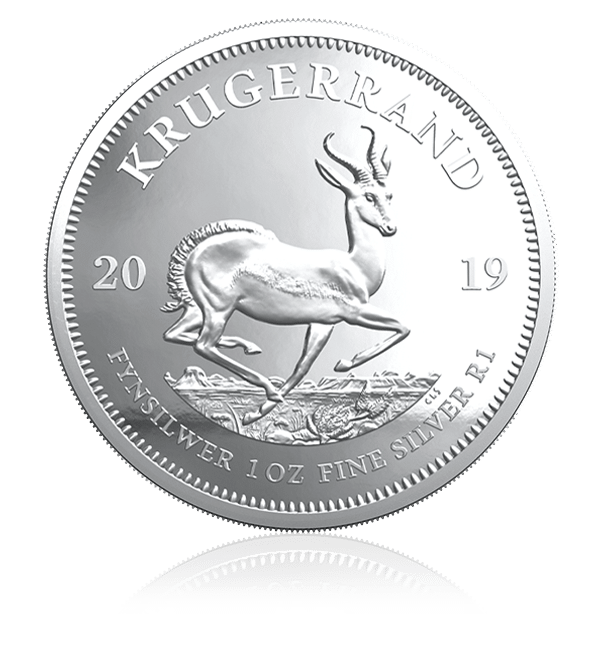

- Krugerrands: These iconic Gold coins are available from Gold Stock Investment as one-ounce, one-half, one-quarter and one-tenth of an-ounce coins, and a one-ounce Silver version.

- Bullion Bars: Gold Stock Investment offers a choice of 100-, 50-, and 10-gram minted Gold bars plus 100-gram, 500-gram and one-kilogram cast Silver bars.

All coins and bars are stamped, assuring their weight and purity.

During turbulent financial times, Precious Metals have proved to be a stable investment offering consistent long-term positive returns. So, why not spend a few moments browsing our Gold and Silver Krugerrand collection or take a closer look at our Bullion bars and start building your investment portfolio today?

Disclaimer: The information above was derived from reliable sources and deemed accurate at the time of writing. However, changes following publication may have affected its accuracy. Such changes may occur without notice, and Gold Stock Investment cannot be held liable for inaccuracies in this article’s content or how a reader may choose to interpret it.